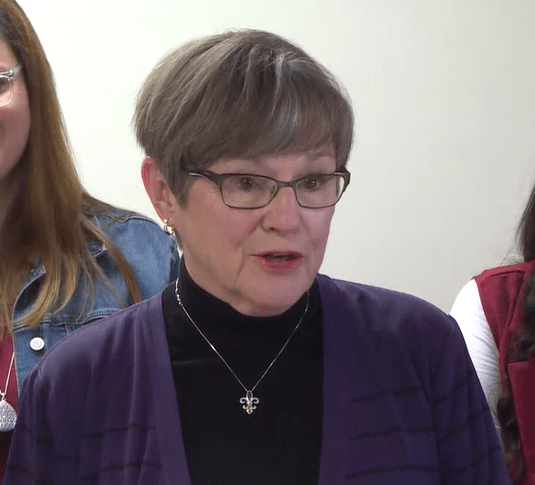

Kansas Governor Laura Kelly made an appearance at a Wichita child care center on Wednesday to talk about her plan to bring the sales tax on groceries to an end.

The governor said she is proud of a bipartisan bill approved last year to phase out the state sales tax on groceries, but she said it doesn’t go far enough or fast enough. She talked about her “Axing Your Taxes” plan that will be submitted to the Kansas Legislature in the upcoming session. One phase of the plan will completely eliminate the sales tax on groceries. Another phase of the plan will eliminate the sales tax on diapers and feminine hygiene products, and Kelly said this will save Kansans over $20 million over the next three years.

Kelly said the grocery tax in Kansas has been one of the highest in the country, and inflation is affecting everyone, including day care providers.

Another bill in the Governor’s plan will create a sales tax holiday on school supplies. The bill would create a four-day window in August of each year so Kansas families can buy school supplies tax free, making back-to-school shopping more affordable.

A third bill deals with the state income tax on Social Security benefits. Retirees who make more than $75,000 a year are now taxed on those benefits, and the bill will raise that threshold to $100,000. Kelly said that will save Kansas seniors more than $50 million over the next three years.

Kelly said the bills will need bipartisan support, and she is calling on lawmakers to approve them. She’s also calling on citizens to contact their lawmakers to urge support for the tax plan.